While a single earner of $one hundred,000 will face additional tax brackets as excessive as 24%. You then pay or obtain curiosity based on the principal quantity. Portfolio – The combination of all of your investment belongings – shares, bonds, treasured metals, actual estate, money, and so forth. Payday Loan – A short-time period loan with a high-interest rate that a borrower pledges to pay again when they obtain their next paycheck (wages).

Lien – A creditor’s right to safe a debt towards the property of a borrower. When a debt obligation just isn’t met, the property could also be bought to cowl the outstanding stability owed.

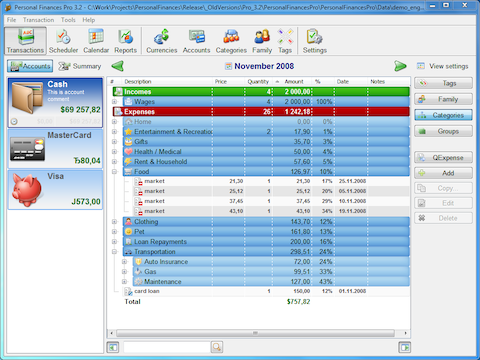

What is the best financial software for personal use?

The three major areas of business finance are corporate finance, investments, and financial markets and institutions.

Liabilities – A legal responsibility, often to pay some sum of money in the future. Lease – The lender pledges some asset to a borrower for a specified time period. The borrower should pay periodically and return the asset at the finish of the agreement. Junk Bond – Investment in some debt that is considered risky, somewhat, that has a higher likelihood to not be repaid. Joint Account – An account with two or more owners, every having legal rights to the funds in the account.

Overdraft – Withdrawing more money than one has in a bank account, often accompanied by charges from the financial institution. Mutual Fund – An funding Personal Finance fund that pools together investors’ money to buy a diverse portfolio of holdings.

Who is the father of finance?

Many sources recommend saving 20 percent of your income every month. According to the popular 50/30/20 rule, you should reserve 50 percent of your budget for essentials like rent and food, 30 percent for discretionary spending, and at least 20 percent for savings.

Credit Score Ranges: How Do You Compare?

Currency – Items exchanged as a type of fee for a good or service, sometimes physical coins or paper cash, more recently digital. Creditor – A particular person or firm that has loaned out money to a borrower. Credit Score – The numerical expression of a borrower’s historic https://1investing.in/personal-finance/ capacity to pay again money owed. A well-liked measure is a FICO® Score, which merely is the score compiled by the company FICO ( Fair Isaac Corporation).

Money Market Deposit Account – An curiosity-bearing account offered by a financial institution. Line of Credit – A certain amount of credit score extended to a borrower that can be utilized at any time up https://1investing.in/ to the maximum out there limit. For instance, a borrower could receive a $10,000 line of credit score and use $5,000 of it instantly, and one other $5,000 in six months.

- Spend a while in your payments, your living expenses, what you’re spending cash on, your financial savings, etc.

- Yet, budgeting is a personal finance fundamental all should master at first.

- Write all of it down, put a plan collectively, and study why this issues.

- And third, having extra money might help you enhance your emergency fund or develop retirement savings.

- Second, when you have debt, adding extra money back into your budget may help you pay it off sooner.

- First, it could release extra money in your finances, so that you’re less inclined to rely on credit cards or loans to cover spending gaps.

Free Online Personal Finance Classes

Investment Policy Statement– A written explanation of your investment philosophy and the logic and methods you’ll use to succeed in specific targets and goals. Interest Rate – The amount https://www.binance.com/ you have to pay to borrow money from a lender. Home Equity Loan – Essentially a second mortgage in which you borrow money using the fairness in a home as collateral for money borrowed.

Guarantor – Another word for co-signer, a guarantor is somebody who pledges to pay some debt should the preliminary borrower stop assembly their obligation to the lender. Fraud – The intentional act of utilizing false or deceptive data by an individual for personal or monetary acquire. Financial Asset – Some investment that is anticipated to extend in value over time, like property. Escrow – A monetary association between two-events who enlist a 3rd celebration to hold funds or property in safekeeping pending the completion of a transaction or obligation.

For example, 10% of your earnings is topic to tax if you are single and earn beneath $9,875 in 2020. While a single particular person incomes Personal Finance $forty,000 in 2020 shall be taxed 10% on the first $9,875 of earnings and 12% on the following $30,one hundred twenty five.

Secured Debt – A mortgage backed by property, a vehicle, or other collateral. Reverse Mortgage – A loan that uses the equity of a home as collateral till it’s repaid, often occurring when the house is offered. Generally, a reverse mortgage is more expensive than a house equity loan and no payments https://cex.io/ are made till the tip of the loan. Real Estate Investment Trust (REIT) – An funding company that owns and operates revenue-generating properties. Progressive Income Tax – An graduated earnings tax system that taxes a larger proportion of income because the earnings rises.

Years After The Financial Crisis: What 2008 Taught Us Not To Do With Our Money

Down Payment – The initial fee in the direction of an funding that requires some form of financing. Demand for Payment – A legal letter/doc detailing a debt obligation, including the quantity owed, how and when the debt should be repaid and the results of non-cost. Debtor – A person https://www.beaxy.com/ or company that is paying back cash to some lender. Debt Settlement – The negotiating of debt balances with creditors to reduce the debtor’s quantity owed. Debt Consolidation – A form of refinancing where one massive mortgage is taken out to repay a number of smaller loans.

What are the 4 types of loans?

In business, the finance function involves the acquiring and utilization of funds necessary for efficient operations. Finance is the lifeblood of business without it things wouldn’t run smoothly. It is the source to run any organization, it provides the money, it acquires the money.